Zakat in Islam: Ultimate Guide to Zakat Rules, Nisab & Calculation

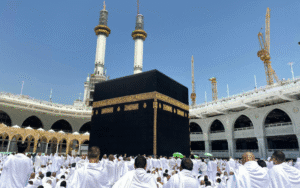

Zakat is one of the five fundamental pillars of Islam. After faith (Iman) and prayer (Salat), Zakat in Islam is the most crucial financial act of worship. It is not merely a donation but an obligatory divine command designed to purify one’s wealth and soul. The very word “Zakat” carries the meanings of purity, growth, and blessing.

In the Holy Quran, Allah (SWT) commands the establishment of prayer alongside the payment of Zakat in numerous verses. For His obedient servants, it is a promise of spiritual purification, immense reward, mercy, and forgiveness.

Allah (SWT) says:

وَ اَقِیْمُوا الصَّلٰوةَ وَ اٰتُوا الزَّكٰوةَ ؕ وَ مَا تُقَدِّمُوْا لِاَنْفُSكُمْ مِّنْ خَیْرٍ تَجِدُوْهُ عِنْدَ اللّٰهِ ؕ اِنَّ اللّٰهَ بِمَا تَعْمَلُوْنَ بَصِیْرٌ۱۱۰

“And establish prayer and give zakat. And whatever good you put forward for yourselves – you will find it with Allah. Indeed, Allah is Seeing of what you do.”

(Surah Al-Baqarah: 110)

In another verse, Allah (SWT) instructs His Messenger (peace be upon him):

خُذْ مِنْ اَمْوَالِهِمْ صَدَقَةً تُطَهِّرُهُمْ وَ تُزَكِّیْهِمْ بِهَا

“Take, [O, Muhammad], from their wealth a charity by which you purify them and cause them increase…”

(Surah At-Tawbah: 103)

The Importance of Zakat in Islam

When we study the Quran, we find that Zakat in Islam is inextricably linked to the identity of a true believer, the path to attaining closeness to Allah, the upkeep of mosques, and the criteria for receiving divine help. Allah (SWT) indispensably mentions Salah and Zakat when describing the characteristics of the truly pious, the righteous, and the faithful.

This demonstrates that it is impossible to imagine a complete faith that ignores or denies the obligation of Zakat in Islam. Renowned Islamic scholars are unanimous that Zakat is such an undeniable tenet of the faith that anyone who rejects its obligation steps outside the fold of Islam.

What Are the Consequences of Neglecting Zakat?

Just as there is a promise of immense reward for paying Zakat, there is a dire warning for those who are negligent or miserly in fulfilling this obligation.

Allah (SWT) warns:

وَ لَا یَحْسَبَنَّ الَّذِیْنَ یَبْخَلُوْnَ بِمَاۤ اٰتٰىهُمُ اللّٰهُ مِنْ فَضْلِهٖ هُوَ خَیْرًا لَّهُمْ ؕ bَلْ هُوَ شَرٌّ لَّهُمْ ؕ سَیُطَوَّقُوْnَ مَا بَخِلُوْا بِهٖ یَوْمَ الْقِیٰمَةِ ؕ

“And let not those who covetously withhold what Allah has given them of His bounty think that it is good for them. Rather, it is evil for them. They will be collared with what they withheld on the Day of Resurrection…”

(Surah Al-Imran: 180)

In a hadith, the Messenger of Allah (peace be upon him) said:

“Whoever is given wealth by Allah but does not pay its Zakat, on the Day of Resurrection his wealth will be made like a poisonous, bald-headed snake with two black spots over its eyes. It will encircle his neck and bite his jaws, saying, ‘I am your wealth, I am your hoarded treasure.'”

(Sahih al-Bukhari, Hadith: 1403)

Who is Obligated to Pay Zakat? (Key Conditions)

According to Islamic law, Zakat is not obligatory upon everyone. To be obligated to pay Zakat, a person must meet several specific conditions:

- Be a Muslim: Zakat is an act of worship, so it is obligatory only upon Muslims.

- Be an Adult (Baligh): Zakat is not obligatory on the wealth of a minor.

- Be of Sound Mind: A person who is mentally incapacitated is not required to pay Zakat.

- Possess the Nisab: The “Nisab” is the minimum amount of wealth a person must own for Zakat to become due.

- Completion of One Lunar Year (Hawl): Zakat becomes obligatory after one full Islamic (lunar) year has passed while one’s wealth has remained at or above the Nisab.

What Types of Assets Are Subject to Zakat?

Zakat is not due on all types of possessions. Shariah has primarily designated four categories of wealth as Zakat-able:

- Gold and Silver: Zakat is due on all gold and silver, including jewelry, whether it is worn regularly, occasionally, or kept in storage. Zakat is also due on gold or silver bars, coins, utensils, or any other form.

- Cash and Liquid Assets: This includes physical cash on hand, bank balances, fixed deposits (FDRs), bonds, stocks, and the accessible/withdrawable amount in a provident fund.

- Business Assets (Goods for Trade): Anything purchased with the intention of resale for profit is a business asset. This includes merchandise in a store, inventory in a warehouse, real estate or plots bought for resale, cars in a dealership, furniture for sale, or any item intended for commerce.

- Livestock: Zakat is due on grazing livestock (camels, cattle, goats/sheep) that meet specific quantity and pasturing conditions (which have their own detailed calculations).

Important Note: Zakat is not due on other metals or precious stones (like diamonds, pearls, or platinum) if they are for personal use. However, if these items are part of a business’s inventory, Zakat must be paid on their value.

Understanding the ‘Nisab’: The Minimum Nisab Amount for Zakat

The “Nisab” is the minimum threshold of wealth, or Nisab amount, a person must own for Zakat to become due.

- The Nisab for Gold: 20 Mithqals, which is equivalent to 7.5 tola or 85 grams of pure gold.

- The Nisab for Silver: 200 Dirhams, which is equivalent to 52.5 tola or 595 grams of pure silver.

A Crucial Ruling: When calculating the Nisab for cash, business assets, or other liquid assets, which standard should be used? The majority of Islamic jurists recommend using the value of the silver Nisab (52.5 tola / 595 grams of silver). This is because the silver threshold is lower, thus making more people eligible to pay Zakat and, consequently, providing greater benefit to those eligible to receive Zakat.

Combined Assets: If you do not own enough gold or silver to meet their respective Nisab, but you have a combination of some gold, some silver, some cash, and some business assets, you must combine their total value. If this combined value equals or exceeds the current market value of the silver Nisab (595 grams of silver), then you are obligated to pay Zakat on the total sum.

What Assets Are Exempt from Zakat?

There are many possessions in our daily lives that are not subject to Zakat. These are considered “Hajat-e-Asliyah” or basic necessities. They include:

- The house you live in.

- Personal clothing (no matter how much or how valuable).

- Household furniture (beds, freezers, AC units, sofas, etc.).

- Household utensils (pots, pans, dishes).

- Personal vehicles (car, motorcycle).

- Tools of one’s trade (a writer’s computer, an engineer’s equipment, a farmer’s plow and cattle).

- Properties rented out (houses, shops). However, please note: While the property itself is exempt, the saved rental income from it is subject to Zakat if it reaches the Nisab and is held for a year.

How Debts and Receivables Affect Your Zakat in Islam

If you are in debt: If you have personal debts (taken for basic needs) that, after being paid, would reduce your remaining wealth below the Nisab, then Zakat is not obligatory on you.

- However: Debts taken for business expansion, factory construction, or building properties for rent or resale (development loans) are not fully deducted from your Zakat-able assets. Only the installment due for that year may be deducted; the entire loan amount cannot be.

If you are owed money (Receivables): Money that you have loaned to others or are owed from a sale is considered your asset. Zakat is due on this amount. The common practice is to pay the Zakat for all past years once you receive the payment.

How to Pay Zakat Correctly: Key Zakat Rules

The most crucial element in paying Zakat in Islam is Ikhlas (sincerity). If Zakat is given to show off or to make the recipient feel indebted, it will not be accepted.

- Intention (Niyyah): One of the key Zakat rules is to have the intention (Niyyah) of paying Zakat. This can be done when you set the money aside or when you give it to low-income people.

- Timeliness: Zakat becomes due as soon as your lunar year is complete. It should be paid promptly without unnecessary delay.

- The Rate: The Zakat rate for wealth (cash, gold, silver, business assets) is one-fortieth (2.5%) of your total Zakat-able assets.

- How to Give: You can pay the 2.5% in cash or give items of equivalent value (such as clothing, food, or other necessities).

- No Need to Announce: You do not need to embarrass the recipient by telling them, “This is Zakat money.” As long as you have the intention in your heart, it will be fulfilled, even if you present it as a “gift” or “help.”

- Forgiving a Debt: If a poor person owes you money, you cannot simply forgive that debt as your Zakat payment. The proper method is to first give them the Zakat money, and then, if you wish, you may ask for your loan to be paid back from that money.

Who Can Receive Zakat? The 8 Eligible Categories

Allah (SWT) has explicitly defined in the Quran who is eligible to receive Zakat. It cannot be given outside of these eight categories.

اِنَّمَا الصَّدَقٰتُ لِلْفُقَرَآءِ وَ الْمَسٰكِیْنِ وَ الْعٰمِلِیْنَ عَلَیْهَا وَ الْمُؤَلَّفَةِ قُلُوْبُهُمْ وَ فِی الرِّقَابِ وَ الْغٰرِمِیْنَ وَ فِیْ سَبِیْلِ اللّٰهِ وَ ابْنِ السَّبِیْلِ ؕ فَرِیْضَةً مِّنَ اللّٰهِ ؕ وَ اللّٰهُ عَلِیْمٌ حَكِیْمٌ۶۰

“Zakat expenditures are only for the poor (al-fuqara’) and for the needy (al-masakin) and for those employed to collect [zakat] and for bringing hearts together [for Islam] and for freeing captives [or slaves] and for those in debt and for the cause of Allah and for the [stranded] traveler – an obligation [imposed] by Allah. And Allah is Knowing and Wise.”

(Surah At-Tawbah: 60)

In simple terms, the recipients are:

- Al-Fuqara’ (low-income people): Those who have nothing.

- Al-Masakin (The Needy): Those who have some income, but it is not enough to meet their basic needs.

- Zakat Collectors: Those officially appointed by an Islamic state to manage Zakat.

- To Reconcile Hearts: (Often new Muslims or those sympathetic to Islam).

- To Free Captives: (In current times, this is rare).

- Those in Debt: A person whose debts exceed their assets.

- In the Cause of Allah: Those striving in Allah’s path (e.g., a student of sacred knowledge with no income).

- The Stranded Traveler: A traveler who, despite being wealthy at home, is stranded and out of money.

Important:

- For Zakat to be valid, the recipient must be made the owner of the wealth.

- Zakat money cannot be used for public works projects like building mosques, schools, bridges, or paying the salaries of Imams. This is because Zakat must be given into the ownership of an eligible person. (However, Zakat can be given to a poor student in a madrassah for their food, lodging, and educational needs, as this makes them the owner).

Who Cannot Receive Zakat?

- A non-Muslim (though voluntary charity, Sadaqah, can be given).

- A wealthy person (someone who owns the Nisab amount).

- Your immediate family and dependents:

- Parents, Grandparents (and higher).

- Children, Grandchildren (and lower).

- One’s spouse (husband and wife cannot give Zakat to each other).

- Relatives: While you cannot give Zakat to the direct-line relatives listed above, giving Zakat to your other relatives (like poor siblings, uncles, aunts, or cousins) is considered the best form of Zakat. It fulfills the right of kinship and the duty of charity simultaneously.

Zakat vs. Other Charities (Sadaqah)

It is important to distinguish Zakat al-Mal (the annual obligatory charity) from other forms of giving:

- Sadaqat al-Fitr: The mandatory purification charity due by every Muslim at the end of Ramadan.

- Sadaqah Jariyah: Voluntary charity that brings continuous reward even after death

Final Thoughts: The Key to Spiritual and Social Harmony

Zakat in Islam is not just an annual tax or a simple donation; it is a divine system for building a compassionate and balanced society. It purifies the heart of the wealthy from greed and miserliness, and it secures Allah’s blessing (barakah) in their remaining wealth. On the other hand, it provides economic security to the less fortunate, ensuring their basic right to a dignified life.

Through Zakat, a spiritual and humane bridge is built between the rich and low-income people. It eradicates jealousy and resentment, replacing them with a beautiful environment of empathy and mutual love. Therefore, by fulfilling the obligation of Zakat correctly, we not only obey Allah’s command but also contribute directly to our own spiritual peace and the formation of a just, beautiful, and equitable society.

Frequently Asked Questions

What is the Nisab amount?

Nisab is the minimum threshold of wealth that makes Zakat obligatory. It is equal to the value of 85 grams of gold or 595 grams of silver.

Who Cannot Receive Zakat?

Zakat cannot be given to non-Muslims, anyone who possesses the Nisab amount (the wealthy), or your immediate family (parents, children, grandparents, or spouse). However, it is highly encouraged to give Zakat to other poor relatives like siblings, aunts, or uncles.

Who Can Receive Zakat?

Zakat is specifically for eight categories mentioned in the Quran, including low-income people (Al-Fuqara' and Al-Masakin), those in debt, and the stranded traveler.

What is the Zakat rate?

The required Zakat rate for eligible wealth (Zakat al-Mal) is 2.5% (one-fortieth) of the total Zakat-able assets held for one lunar year.