Interest in Islam: A Complete Guide to Riba & Its Prohibition

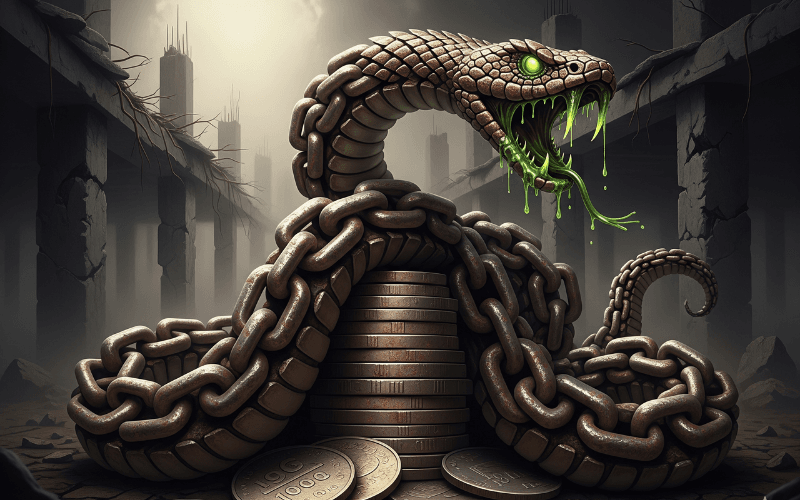

Among the matters Islamic Sharia declares as Haram (forbidden), the prohibition against Interest in Islam is one of the most severe. The modern global economy is deeply entangled in the web of interest. Consequently, many Muslims harbor doubts and confusion about its prohibition. However, interest is a destructive act. It corrodes an individual’s faith (Iman) and character (Akhlaq) and destroys society’s economic fabric from its roots. This matter is so grave that Allah the Almighty and His Messenger (ﷺ) have declared war against anyone involved in it.

In this article, we will explore—in the light of the Quran and Hadith—what Riba is, its types, its historical context, some common misconceptions, its devastating consequences, and the path to salvation from it.

Understanding Interest in Islam: Riba’s Types and Historical Context

The Arabic word ‘Riba’ (الربا) literally means increase, addition, growth, or inflation.

In Islamic terminology, interest is any uncompensated surplus in a loan transaction. It is the extra amount taken or given over the principal simply in exchange for time. The companions of the Prophet (Sahaba) and all Islamic jurists (Fuqaha) are unanimous on the principle: “Every loan that brings a benefit to the lender is Riba.”

Islam primarily identifies two types of interest:

1. Riba An-Nasi’ah (ربا النسيئة): The Interest of Delay

This refers to time-based interest. Riba An-Nasi’ah is the extra amount charged on the principal for a delay or extension in the repayment period. All interest-based transactions from modern banks, NGOs, or individuals fall under this category. The Messenger of Allah (ﷺ) said,

“Interest is in delaying payment.”

(Sahih Muslim, Hadith: 1596)

2. Riba Al-Fadl (ربا الفضل): The Interest of Excess

This occurs when two similar commodities are exchanged on the spot but in unequal amounts. It is essentially interest within a barter transaction. The Messenger of Allah (ﷺ) clarified this principle by mentioning six specific items:

“Gold for gold, silver for silver, wheat for wheat, barley for barley, dates for dates, and salt for salt—must be exchanged in equal measure and hand-to-hand (on the spot). Whoever gives more or asks for more has engaged in Riba. The giver and the taker are equally guilty.”

(Sahih Muslim, Hadith: 1584)

A practical example: A companion once brought high-quality dates to the Prophet (ﷺ), who asked about their source. The companion explained that he had exchanged two ‘Sa’ (a unit of measure) of inferior dates for one ‘Sa’ of superior dates. The Prophet (ﷺ) replied,

“Do not do this. Instead, sell the inferior dates for a price, and then use that money to buy the good dates.”

(Sahih Muslim, Hadith: 1594)

This principle shows that the prohibition of Riba is not limited to loans. It also applies to the unequal exchange of like-for-like commodities.

Addressing a Common Misconception: Commercial vs. Usurious Interest

Some people attempt to justify interest with a deceptive argument. Specifically, they claim the Quran only forbade interest on loans for personal needs (usurious interest). They contend that modern commercial interest is not Haram because it did not exist in the pre-Islamic era (Jahiliyyah). However, this idea is entirely baseless and invalid for two key reasons.

- Prohibition is Based on Principle, Not Method: Firstly, when Islam forbids something, the ruling is based on its fundamental nature; a change in method does not alter the ruling. For instance, the methods of producing alcohol have changed over centuries, but alcohol remains Haram. Therefore, the Quranic prohibition on interest in Islam applies to all its forms, regardless of the method.

- The Existence of Commercial Interest in the Pre-Islamic Era: Secondly, history proves that commercial interest was, in fact, prevalent during that time. Major traders and communities regularly engaged in large-scale, interest-based lending. As such, the Quran’s prohibition is comprehensive, covering both personal and commercial interest.

The Severity of Interest in Islam: Rulings from the Quran and Hadith

Declarations from the Quran:

Rising on the Day of Judgment in a State of Insanity:

الَّذِينَ يَأْكُلُونَ الرِّبَا لَا يَقُومُونَ إِلَّا كَمَا يَقُومُ الَّذِي يَتَخَبَّطُهُ الشَّيْطَانُ مِنَ الْمَسِّ

“Those who consume interest will not stand [on the Day of Resurrection] except like one who is being beaten by Satan into insanity.”

(Surah Al-Baqarah, 2:275)

A Declaration of War from Allah and His Messenger:

يَا أَيُّهَا الَّذِينَ آمَنُوا اتَّقُوا اللَّهَ وَذَرُوا مَا بَقِيَ مِنَ الرِّبَا إِن كُنتُم مُّؤْمِنِينَ. فَإِن لَّمْ تَفْعَلُوا فَأْذَنُوا بِحَرْبٍ مِّنَ اللَّهِ وَرَسُولِهِ

“…But if you do not, then be warned of a war [against you] from Allah and His Messenger.”

(Surah Al-Baqarah, 2:278-279)

The Destruction of Blessings in Wealth:

يَمْحَقُ اللَّهُ الرِّبَا وَيُرْبِي الصَّدَقَاتِ

“Allah destroys interest and gives increase for charities.”

(Surah Al-Baqarah, 2:276)

Warnings from the Hadith:

- Worse Than Adultery with One’s Own Mother: The Messenger of Allah (ﷺ) said, “Riba has seventy levels of sin, the lowest of which is equivalent to a man marrying (committing adultery with) his own mother.” (Sunan Ibn Majah, Hadith: 2274)

- Worse Than Thirty-Six Acts of Adultery: He (ﷺ) also said, “A single dirham of Riba which a man consumes knowingly is worse than committing adultery thirty-six times.” (Musnad Ahmad)

- All Parties Involved are Cursed: Jabir (RA) reported that “The Messenger of Allah (ﷺ) cursed the one who consumes Riba, the one who pays it, the one who writes it down, and its two witnesses. He then said, ‘They are all equal (in sin).'” (Sahih Muslim, Hadith: 1598)

- One of the Seven Destructive Sins: The Prophet (ﷺ) warned against seven destructive sins, one of which is “consuming Riba.” (Sahih al-Bukhari, Hadith: 2766)

The Devastating Consequences of Riba on Human Life

The harm of interest in Islam extends beyond the Hereafter, causing severe impacts on life in this world.

Worldly Consequences:

- Financial Ruin: Interest may appear to increase wealth, but it ultimately leads to ruin and removes blessings (Barakah). The Messenger of Allah (ﷺ) said, “No matter how much interest increases, its ultimate end is poverty.” (Musnad Ahmad, Hadith: 3754)

- War with Allah and His Messenger: Engaging in interest is like declaring war on Allah and His Messenger. This act deprives a person of Allah’s help in this world.

- Divine Curse: Those involved with interest fall under the curse of Allah’s Messenger (ﷺ), which strips peace from their lives.

- Social Decay: Interest breeds greed, selfishness, and exploitation. It erodes mercy, empathy, and cooperation within a community.

- Inviting Divine Punishment: A society where adultery and interest become common makes itself deserving of Allah’s punishment. (Hakim, Hadith: 2261)

Consequences in the Hereafter:

- A Terrible Punishment in the Grave: In the Barzakh (the period between death and resurrection), angels will force the consumer of Riba to swim in a river of blood, striking his mouth with stones. (Sahih al-Bukhari, Hadith: 2085)

- A Humiliating Resurrection: On the Day of Judgment, Allah will raise the consumer of Riba in a state of insanity, like one possessed by Satan. This will be a source of extreme humiliation.

- Non-Acceptance of Worship: Allah will not accept the worship or supplications of a person whose body is nourished by unlawful earnings. The Prophet (ﷺ) said, “Allah the Almighty is Pure and accepts only that which is pure.” (Sahih Muslim, Hadith: 1015)

- The Ultimate Destination is Hellfire: A body nourished by illicit food is destined for the Hellfire. (Sunan al-Tirmidhi, Hadith: 614)

The Path to Salvation from Riba

A believer must take the following steps to avoid this grave sin:

- Fear of Allah and Taqwa: Cultivate the fear of Allah in your heart. Firmly believe that wealth earned through forbidden means has no blessing.

- Acquiring Islamic Knowledge: Seek clear knowledge about what Riba is. Understand the specific rulings on interest in Islam and which transactions are forbidden.

- Choosing Islamic Finance: Opt for interest-free Islamic banks and financial institutions for all personal and business dealings.

- Promoting Qard Al-Hasana (Benevolent Loans): Revive the practice of interest-free loans. Foster a culture of helping those in need without seeking any profit.

- Cultivating Contentment (Qana’ah): Learn to be content with what you have. Stay free from the burden of unnecessary debt.

- Sincere Repentance (Tawbah): If you were involved in interest in the past, abandon it immediately. Turn to Allah in sincere repentance.

Conclusion

Interest is a silent killer. It destroys faith, society, and the economy from within. A true Muslim can never compromise on this forbidden transaction. Declaring war against Allah and His Messenger (ﷺ) for a small worldly gain is the greatest foolishness.

May Allah Ta’ala grant us all the ability (Tawfiq) to stay away from this destructive sin and to live our lives through lawful earnings. Ameen!

Frequently Asked Questions

What is Riba (Interest) in Islam, and why is it forbidden?

The Arabic word "Riba" means an increase or surplus. In Islamic terminology, it refers to any uncompensated surplus in a loan transaction. It is strictly forbidden (Haram) because it promotes exploitation, greed, and injustice. It corrodes a person's faith and character and destroys the economic fabric of society.

What are the two main types of Riba?

Islam identifies two main types of Riba:

- Riba An-Nasi'ah (Interest of Delay): This is the time-based interest charged on the principal amount of a loan for an extension in the repayment period. This includes all forms of interest-based transactions in modern banks.

- Riba Al-Fadl (Interest of Excess): This occurs in barter transactions when two similar commodities (like gold, wheat, or dates) are exchanged in unequal amounts.

What is the severity of consuming Riba according to the Quran and Hadith?

The prohibition of Riba is one of the most severe in Islam. The Quran and Hadith contain strong warnings, including:

- A declaration of war from Allah and His Messenger against those who consume Riba.

- A warning that the consumer of Riba will rise on the Day of Judgment in a state of insanity, like one beaten by Satan.

- The Prophet (ﷺ) said that a single dirham of Riba is worse than committing adultery 36 times.

- Allah curses not only the one who consumes Riba but also the one who pays it, the one who writes it down, and the two witnesses.

What are some of the consequences of Riba in this life and the Hereafter?

Engaging in Riba has devastating consequences in this life and the next:

- Financial Ruin: It removes blessings (Barakah) from wealth, and its ultimate end is poverty.

- Social Decay: It breeds selfishness and erodes mercy and cooperation within a community.

- A Painful Punishment in the Grave: The consumer of Riba will be forced to swim in a river of blood while being struck with stones.

- Non-Acceptance of Worship: A body nourished by unlawful earnings is destined for the Hellfire, and Allah will not accept its acts of worship.